Furniture amortization rate

Update your entire room for 30mo based on 60-mo term with equal monthly payments. Amortization as a way of.

Depreciation Nonprofit Accounting Basics

Depreciation 1000 purchase price 200 salvage value 10 years useful life Depreciation 80010.

. You can call 1. The calculator should be used as a general guide only. This represents the annual.

PenFed Offers Adjustable-Rate Mortgages ARMs to Suit your Needs. Ad 1800 retail Restrictions apply. Generally amortization schedules only work for fixed-rate loans and not adjustable-rate mortgages variable rate loans or lines of credit.

Thats your interest payment for your first monthly payment. Loan programs and rates can vary by state. It also determines out how much of your repayments will go towards.

Subtract that from your monthly payment to get your principal payment. If your interest rate is 5 percent your monthly rate would be 0004167 005120004167. Thats your interest payment for your first monthly payment.

The amortization table below illustrates this process calculating the fixed monthly payback amount and providing an annual or monthly amortization schedule of the loan. Ad Ready to Learn About the Benefits of a PenFed ARM Mortgage. Ad 1800 retail Restrictions apply.

View the costs associated with a purchasing a home based on the current market conditions. The Salvation Army offers a free pickup service for individuals who want to donate furniture to the organizations. The depreciation rate of furniture refers to how furniture loses its value over time.

Learn More Apply Today. Free Shipping on All Orders over 35. Mortgage options in New York.

The free pickup for donation services depend on your location. Apply now for jobs that are hiring near you. Get up to 70 Off Now.

The depreciation rate is used for accounting and tax purposes and the rules for the rate vary. Multiply 150000 by 3512 to get 43750. Number of payments over the loans lifetime Multiply the number of years in your loan term by.

Subtract that from your monthly payment to get your principal payment. Ad Buying A Home. Hooker Furniture Hooker Furniture Montebello Wood Seat Side Chair.

This loan calculator - also known as an amortization schedule calculator - lets you estimate your monthly loan repayments. Hooker Furniture Hooker Furniture Montebello Telephone Table. Examples are furniture appliances and tools costing 500 or more.

Ad Choose the Right Amount to Borrow by Calculating Your Monthly Loan Payment. Well Automatically Calculate Your Estimated Down Payment. Its estimated scrap value is 200.

Mortgage Costs Comparison Guides. Ad At Your Doorstep Faster Than Ever. To set yourself up for success and help you figure out how much you can afford get pre-qualified by a licensed New.

There are many variables which can affect an items life expectancy that should be taken into consideration. Class 8 20 Class 8 with a CCA rate of 20 includes certain property that is not included in another class. Update your entire room for 30mo based on 60-mo term with equal monthly payments.

Multiply 150000 by 3512 to get 43750. Search CareerBuilder for Excel Amortization Jobs in montebelloNY and browse our platform. Try Our Fast Easy Online Mortgage Application.

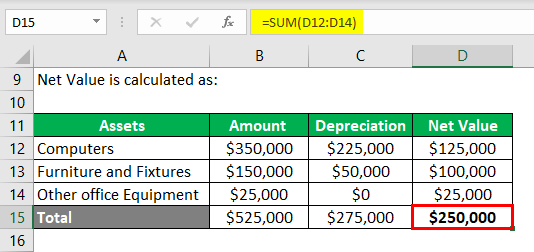

The basic formula using straight line depreciation is purchase price less salvage value divided by the total number of years of useful life.

What Is Amortization Bdc Ca

Depreciation Rate Formula Examples How To Calculate

/JCPIncomestatementMay2019Investopedia-ef93846733094d2cbd1fdfe97126b3bc.jpg)

Are Depreciation And Amortization Included In Gross Profit

![]()

Furniture Calculator Splitwise

/dotdash_Final_Why_is_Accumulated_Depreciation_a_Credit_Balance_Jul_2020-01-34c67ae5f6a54883ba5a5947ba50f139.jpg)

Why Is Accumulated Depreciation A Credit Balance

/JCPIncomestatementMay2019Investopedia-ef93846733094d2cbd1fdfe97126b3bc.jpg)

Are Depreciation And Amortization Included In Gross Profit

Furniture Fixtures And Equipment Ff E Definition

Depreciation Calculator Depreciation Of An Asset Car Property

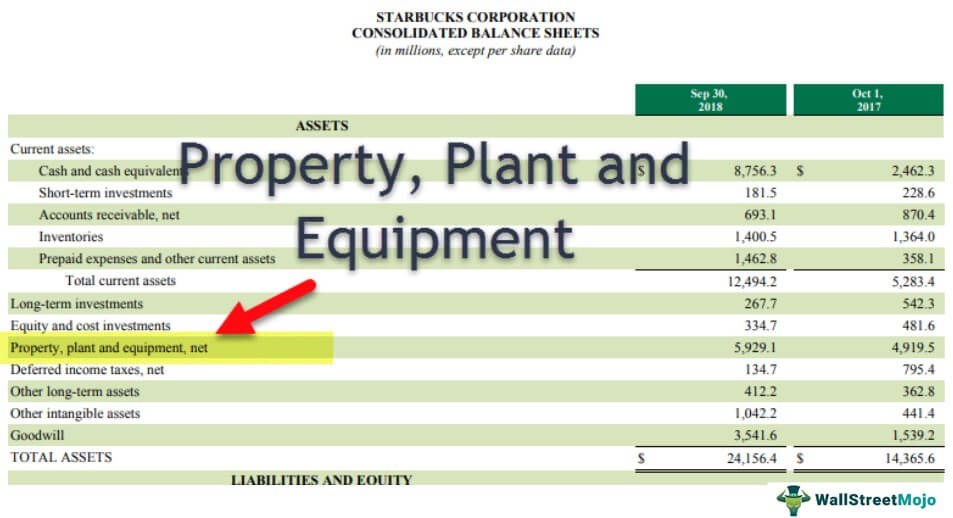

Property Plant And Equipment Pp E Formula Calculations Examples

Accumulated Depreciation Explained Bench Accounting

Depreciation Rate Formula Examples How To Calculate

/ScreenShot2019-01-15at3.35.40PM-5c3e455dc9e77c0001915edd.png)

Amortization Calculator

Fixed Asset Examples Examples Of Fixed Assets With Excel Template

Furniture Depreciation Calculator Calculator Academy

Depreciation Nonprofit Accounting Basics

How To Calculate Depreciation Expense For Business

Depreciation Rate Formula Examples How To Calculate